Can I Get Homeowners Insurance With A Bad Roof?

- Your Good Insurance Agency

- June 6, 2022

- 12:19 pm

So, you live on the sunny west coast, but the hot weather has done a number on your roof. Your mind is spinning with all kinds of worst-case scenarios and questions.

I’m buying a new house, but the roof is old, will I still be able to get homeowners insurance? Will my homeowner’s insurance cover a 15-year-old roof? Does home insurance cover roofs?

Okay hold your horses. We’ll walk you through everything you need to know when it comes to old roofs and homeowners insurance.

Let’s take this step by step.

Getting a Homeowners Insurance Policy for a House with an Old Roof

Whether you own a single-family home, condo, townhome, rental home, vacation rental property – you have plenty of options. Insurance underwriters will use a couple of factors to decide if they want to insure your property and/or roof.

Roof Age and Roof Condition

Both are very important! Here’s why…

The older your roof (25+ years old) the worse your coverage options will be (see Actual Cash Value vs Replacement Cost below). The better condition your roof is in, the easier it will be to get homeowner’s insurance. Insurance carriers want to make sure your roof is in good repair.

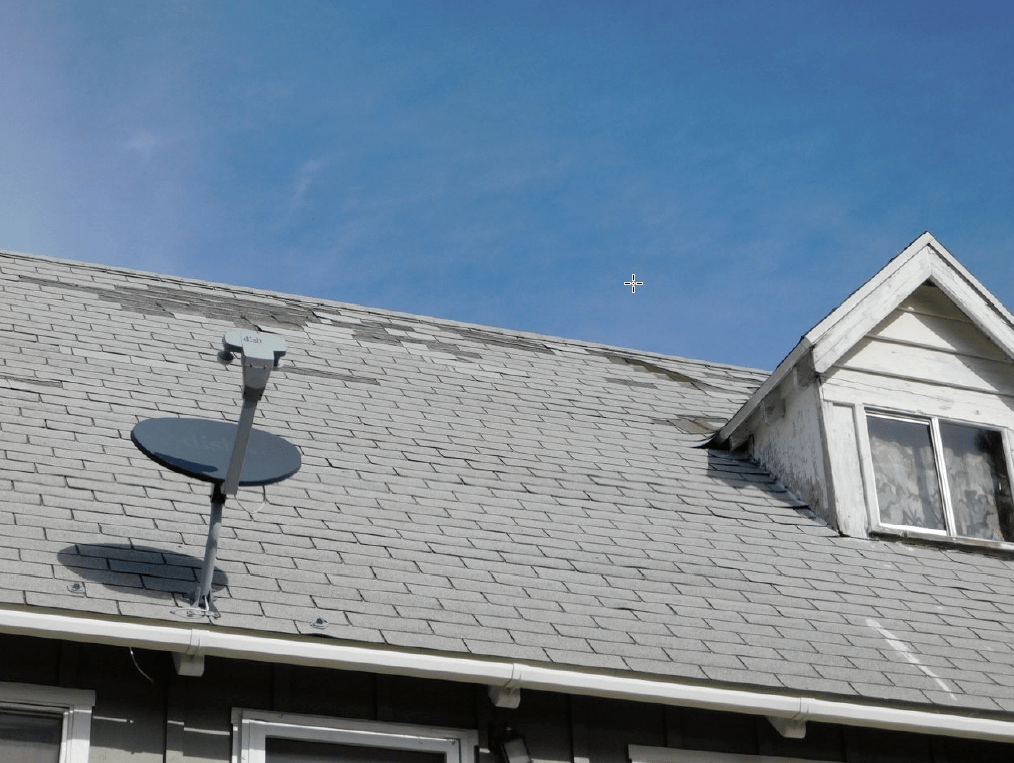

Here’s examples of roofs that are NOT in good condition and might require a roof exclusion in order to get insurance. If this looks like your roof, don’t worry there are still options available to you.

Missing Shingles

Missing Shingles

Lifting Shingles

Regular maintenance to your roof saves you money in the long run. Carriers will do an annual inspection and roofs that are in good condition cause a lot less problems for your insurance. Some roofs are preferred over others. Tile roofs are generally considered more fire resistant so they can have a lower rate depending on the carrier. In brush zones (high risk fire zones) tile roofs might be more likely to be approved.

Roof Type and Roof Shape

Now we are getting technical. But I’ll give you the down low…

Insurers will consider what your roof is made of. Metal roofs are not easy to damage, and hence are the cheapest to insure. Wood roofs are a red flag because they can go up in flames very easily! Which is why insurance carriers in areas prone to brush fire like San Diego, may reject coverage for homes with wood roofs.

Underwriters get very happy when they see a Gable or Hip roof on a property that needs insurance! Gable roofs are shaped like an upside-down V, so water trickles off easily. They are simple in design so can be replaced easily. Hip roofs are four-sided with inward slopes. They are more stable and can handle both wind and snow.

Homes with flat roofs are usually the most expensive to insure, water pools on them and leaks happen often. They also need to be serviced more often. A flat roof might last 10-15 years before being redone where a good shingle roof might last 20-30 years and a good tile roof might last 30-40 years.

I have Homeowners Insurance – Does it Cover My Bad Roof?

Great! You have already passed the first hurdle – getting insurance. Whether or not your roof will be covered depends what coverages are outlined in your specific policy. If you’re not sure what your policy does and doesn’t cover give your insurance agent a call to review – they’re always there to help! So, no need to worry – you are not alone.

It’s worth saying again that insurance companies will not pay for maintenance of your roof. Regular wear and tear are your responsibility.

Below we outline some common damages that are covered in most homeowners insurance policies.

Common Damages to Your Roof Covered by Homeowners Insurance

If there’s damage to your roof and the cause of the damage is covered then the carrier will pay for the claim. The leading causes of covered claims includes damages caused by storms and wind on roofs. Every insurance policy and every carrier are different. So, check with your insurance agent about covered perils in your contract. Here are some common scenarios –

My Roof Leaks – Will it be Covered?

Yes – if the cause of loss is covered. If the leak occurred because of wind damage or a storm then yes, your homeowners policy will usually pay. If the leak is due to neglect or lack of maintenance – chances are that claim might be denied.

What About Ice Damage to My Roof?

When it’s below freezing at night, and it rained for days, ice will accumulate on your roof. This can lead to overflowing water, blocked gutters or even roof collapse. Your policy may cover damage to your roof but not damage inside the home.

A Tree Fell on My Roof!

In most instances a tree falling on your roof will be covered. Although when an inspection is done the carrier might ask for branches of a nearby tree that are overhanging the house to be trimmed away from the roofline.

What About Squirrels and Racoons?

They are adorable! But they can be very annoying at times, especially if they want to share the same roof with you. Don’t ignore the presence of rodents on your roof. Rodents start many house fires by chewing on electrical wires. That is why generally speaking if you have an appliance outside it must be covered to avoid letting little critters chew on the electrical connections and wires. That is also another reason the carriers have you trim the branches of trees overhanging the roof so the critters can’t jump straight from the tree to your roof.

They are adorable! But they can be very annoying at times, especially if they want to share the same roof with you. Don’t ignore the presence of rodents on your roof. Rodents start many house fires by chewing on electrical wires. That is why generally speaking if you have an appliance outside it must be covered to avoid letting little critters chew on the electrical connections and wires. That is also another reason the carriers have you trim the branches of trees overhanging the roof so the critters can’t jump straight from the tree to your roof.

How Much Will I Get Paid for Roof Damage?

First you need to know if your roof is covered using replacement cost or actual cash value. If you’ve owned your home for a while but purchased it with a brand-new roof, the insurance underwriter was most definitely pleased and would have offered you the best possible coverage, which is replacement cost.

What is Replacement Cost?

Replacement Cost is exactly what it sounds like, the cost to replace your entire home including the roof. The carrier uses what is called a Home Cost Estimator (HCE). The HCE takes the public features known about your house including the roof and creates a value for what the house might cost to be rebuilt. Now these are general numbers and many times the HCE will not be exact in attributes of the house so you should always check your HCE to make sure the most important characteristics of the house match up correctly.

What is Actual Cash Value?

Actual Cash Value is insurance lingo to indicate that you will be paid on the cost to replace the roof minus depreciation (depreciation is considered the wear and tear on your house). If your roof was more than 30 years old when you bought your house there is a chance that your home insurance might be based on Actual cash value.

Filing a Claim for Your Roof

This is worth mentioning again – insurance companies will NOT pay for maintenance of your roof. You will want to think of your insurance as home accident insurance not home repair insurance. Regular wear and tear are your responsibility. However, if there is damage to your roof and the cause of the damage is covered, for instance a storm that blows shingles off the roof or a tree that falls on the roof – you are in good shape.

Always speak to your agent first before submitting a claim to review your coverages and to give advice on how to proceed.

Don’t Wait Too Long to File a Claim for Your Roof

Many carriers will give you up to a year to file a claim, but you should call them immediately to find out how long you have because it will vary carrier to carrier.

Take-Aways for Filing a Claim for a Covered Loss on your Roof

- Your agent is your best friend

- Document everything

- File the claim on time

- Stay calm and call your agent!

Find the Best Agent to Help with Damaged Roofs

Make sure you hire the best agent to help you find a policy for your unique situation. One with strong, long-standing relationships with top notch carriers and a LOT of knowledge about tailoring insurance to your needs.

Important Takeaways If You Have a Bad Roof

- The cost to insure your roof will depend on the age, shape, and condition of your roof

- All homes are insurable regardless of the condition of the roof, but it may cost extra or coverage for your roof might be excluded.

- Your Good Insurance Agency is an expert at helping clients find the best possible solution when their house has an old or bad roof. Give us a call to discuss today 800-889-9242! We will help you keep your premium low while ensuring you have maximum coverage. We are licensed in California, Arizona, Nevada, and Utah.

Insurance Made Easy

Get A Quote Now

As a broker we will price this with up to 30 carriers to get you the absolute best price.

About Your Good Insurance Agency

Based in San Diego, California, Your Good Insurance Agency was started in 2008 with the goal of helping people find high quality insurance at a reasonable price.

We work with over 30 carriers to help you get the best rate with good coverage options. We specializes in personal lines insurance with an emphasis on homes, dwellings (rental properties), and autos. We also help investors with property flip Insurance.

Most of our clientele resides in California however we are also licensed in Utah, Nevada, & Arizona.