When It’s Time to Switch Your Homeowners Insurance to CA Fair Plan

- Your Good Insurance Agency

- February 14, 2023

- 2:50 pm

The insurance industry is definitely booming. This typically benefits homeowners because they can choose from a variety of insurance providers and policies to obtain the best possible coverage for a price that fits their budget. Unfortunately, residents in states like California often have a hard time finding affordable coverage, if they can even obtain it at all.

If you received a letter stating your homeowners insurance premiums are going up or a non-renewal, you may worry about what options are left out there for you when it comes to obtaining quality home insurance in a wildfire area. Luckily for you, not all hope is lost.

Sometimes, significant premium increases or sudden non-renewal notices aren’t a sign that your home is impossible to insure. Instead, it just means it might be time to research CA Fair Plan insurance and contact Your Good Insurance Agency to walk you through the process of switching from a traditional homeowners plan to a CA Fair Plan.

Why Did My Homeowners Insurance Premium Increase?

Homeowners nationwide have noticed significant increases in insurance premiums over the past two years. Yet, in many cases, these homeowners haven’t made claims, nor have they made any major changes to their houses. Therefore, many homeowners are asking themselves, “Why did my homeowners insurance premium increase?” Well, the answer to that is just as complicated as the increases themselves.

For example, material costs have increased steadily over the past three years. Everything from lumbar to asphalt shingles has become more expensive. Supply chain issues and inflation have contributed to these price increases, making repairing or rebuilding homes more costly. As a result, insurance providers have started raising insurance rates to match the elevated costs placed on them for claims.

Similarly, the construction industry faces severe labor shortages. Smaller crews mean work gets done, which delays the rebuilding process. Companies charge more due to increased demand and to help attract more workers. However, these costs also trickle down to homeowners through their insurance premiums.

Unfortunately, price increases impact people’s ability to repair and upgrade their homes. As homes age, they become more susceptible to issues that can result in expensive damages. Things like pipes bursting or roofs leaking become more likely when homes age. Therefore, aging homes become more of a hazard for insurance companies. If your potential to file a claim rises, insurance providers increase your rates because they consider your home a higher risk to insure.

Of course, age isn’t the only thing causing claims risks to rise. All across the country, extreme weather events have become far more common. Unseasonably cold temperatures, heat waves, and record storm seasons have hit nearly every part of the country. However, states like Florida, Texas, and our very own California are some of the hardest hit areas by these extreme climate changes.

Severe Weather and Wildfires

The California wildfire season isn’t a new phenomenon. The late summer and early autumn months bring wildfires nearly every year. However, these fires have become more intense and destructive over the past several years due to climate change.

Warmer temperatures and less rainfall have led to prolonged drought seasons. This leads to more dry or dead vegetation, which fuels most wildfires. The more fuel for a wildfire, the more intense and destructive it becomes. Also, wildfire season is lasting longer, meaning homes throughout much of California are susceptible to fire damage anywhere from six to eight months out of the year.

As the risk of wildfires increases yearly, wildfire insurance becomes more necessary than ever before. As most homeowners know, standard insurance policies cover fire damage. However, home insurance in wildfire areas is difficult to obtain. As wildfires increase and become more destructive, homeowners who previously obtained homeowners insurance through traditional means may find themselves battling obscenely high premiums or non-renewal notices as their homes fall into wildfire zones.

How Do You Know if Your Home is in a Wildfire Zone?

Before any provider issues or renews a homeowners insurance policy, the insurance company will assess your house’s risk level. The higher your home’s risk, the more likely you are to file substantial claims, costing the insurance company more money. Companies don’t like this and try to avoid it if possible.

One of the best things informed consumers could do if their insurance coverage increases in cost or disappears is to research whether their property lies within a wildfire zone. Although most of California is always at risk for wildfires, some areas are at higher risk than others.

The California State Fire Marshal’s office must classify all property in the state of California into Fire Hazard Severity Zones (FHSZ). There are three levels, or classifications, of Fire Hazard Severity Zones: moderate, high, and very high. Some properties will not fall into these zones, meaning the house’s fire hazard risk is simply “low,” not non-existent.

The state used a variety of data and considered multiple factors as they determined the fire hazard zones. This included information like the area’s fire history, natural vegetation and other potential fuel, weather, the location’s terrain, and predictions for flame length or blowing embers.

You can use several online tools to determine whether your home falls into a wildfire zone. For example, the state fire marshal’s website offers a Fire Hazard Severity Zone Viewer. You simply enter your address, and will see your property in relation to the three marked fire severity zones.

Similarly, The Los Angeles Times offers a free wildfire hazard zone lookup map that shows your address in relation to the state’s 8,900 very high-risk zones, displayed in red. Although this doesn’t give you the exact zone your address falls in, it can help you determine if you are at an extremely high risk and may therefore need CA Fair Plan fire insurance.

Finally, you can use a website called Risk Factor to look at your home’s risk for any natural disaster, including wildfires. On this website, you simply plug in your address, and it will display a picture of your home (from Google Maps), the location of your home on a standard map, and provide your home’s risk for flooding, wildfire, heat, and wind using a 10-point scale.

Questions That Measure a Home’s Wildfire Risk

Certain things make houses riskier for wildfires regardless of where your home falls within the wildfire zones. Regardless of what zone your home falls into, you can always ask yourself a few simple questions to measure your address’s risk for wildfires.

These questions include:

- Has this house ever experienced wildfire damage?

- What vulnerabilities does the house have?

- Is it hard for you to obtain homeowners insurance?

- Has the neighborhood or community implemented any measures to reduce the wildfire risk?

If you notice certain vulnerabilities or ways the community as a whole could lower your neighborhood’s wildfire risks, then you can take action. Although this won’t immediately impact your wildfire insurance rates, it won’t ever hurt.

Home Insurance in Wildfire Areas

Most standard homeowners insurance policies include provisions for fire damage. However, wildfire insurance is often a separate beast, especially in high-risk areas like California.

Sometimes, you can obtain home insurance in a wildfire area if you pay a higher premium. Traditional carriers may increase your rates naturally due to the risk or drop you entirely. Similarly, surplus or excess lines insurance carriers are often more willing to cover homes that are at higher risk.

There are ways you can make your home less susceptible to fire damage. For example, you can choose fire-resistant roofing materials to make your roof less likely to combust. Similarly, you can choose fire-resistant siding and other building materials. Things like dual-pane windows and removing trees that are close to the home can also reduce this risk.

Unfortunately, even with these measures in place, many insurance providers still won’t take the risk on the house in an area that falls into a very high severity fire zone. Therefore, once no admitted carrier offers you a standard homeowners policy (HO3) due to your home’s proximity to wildfire risk, it’s time to seek coverage with CA Fair Plan insurance.

Obtaining CA Fair Plan Fire Insurance

If you’ve never heard of CA Fair Plan insurance, you may be asking yourself, “What is a CA Fair Plan and how do I obtain CA Fair Plan fire insurance?”

Essentially, CA Fair Plan insurance was designed to help homeowners obtain home insurance in wildfire areas. Evaluators use a 10-point rating scale called Public Protection Classes (PPC) to determine your home’s wildfire risk. If your house qualifies, it will then be inspected to ensure it meets the structural criteria for CA Fair Plan insurance.

The good news is that CA Fair Plan insurance will cover a variety of homes, including rental homes. Properties like condos and duplexes can also qualify for CA Fair Plan insurance, although there are some additional stipulations on what is or is not covered by these policies. There are also add-on policies you can get to fill in the gaps in coverage left by your CA Fair Plan. In other words, unless your home is sitting empty or has severe structural issues, chances are there’s a way to get home insurance in a wildfire area.

Because CA Fair Plan insurance is a named perils policy, it only covers types of damages specifically listed in the policy. Typically, CA Fair Plan fire insurance provides coverage for just that. This includes fires, lightning and smoke damage, and internal explosions.

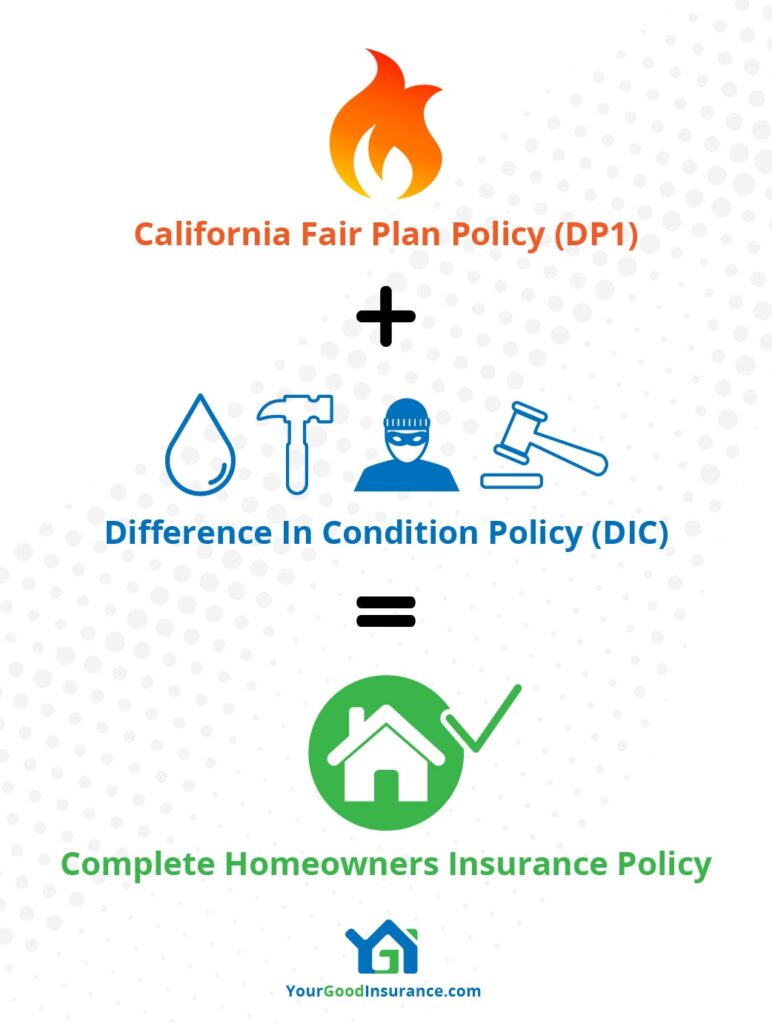

If you need coverage beyond that or for other perils, you must also get a Difference in Conditions policy. This will help extend coverage and add other endorsements onto your policy for things like vandalism, wind, hail, etc.

If you feel like your current insurance premiums are too high for you to sustain or you’ve received a letter of non-renewal, then it’s time to shop around for a new policy. It’s easiest to walk through the CA Fair Plan insurance application process with a broker or agent who knows the ins and outs of these policies and the screening process. Luckily for you, Your Good Insurance Agency is here and ready to help.

Keep Your Home Protected With Your Good Insurance Agency

At Your Good Insurance Agency, we are experts at providing home insurance in wildfire areas. Whether your premiums have climbed significantly or you received a non-renewal notice, we are confident that we can help you find adequate coverage for your house without breaking the bank.

When you contact Your Good Insurance Agency, we will first quote out coverage from admitted carriers just to see if any of them will provide a standard HO3 policy with wildfire insurance. Even if your previous provider dropped you, there’s still a chance that one or two of our admitted carriers will still do it, regardless of the risk.

If a standard HO3 policy doesn’t work, we can obtain CA Fair Plan insurance. This will be a Dwelling Fire Form 1 policy, or DP1. This will give your home protection from fire and several other named perils.

To ensure your home has adequate protection, we also recommend a separate DIC, or Difference in Conditions, policy. This policy will provide additional coverage in the event of a devastating catastrophe and can be essential for anyone who needs home insurance in a wildfire area.

At Your Good Insurance Agency, we offer outstanding CA Fair Plan Fire Insurance and DIC policies. We can compare prices and coverage options through our carrier network to ensure you have everything you need to insure your home. Most of the time, pairing a DP1 policy with DIC coverage is cheaper for individuals who experienced a premium increase with their standard homeowner’s policy.

So, whether you are trying to insure your family home or a vacation rental property, Your Good Insurance Agency is here and ready to help you switch to CA Fair Plan insurance if the time is right.

Insurance Made Easy

Get A Quote Now

As a broker we will price this with up to 30 carriers to get you the absolute best price.

About Your Good Insurance Agency

Based in San Diego, California, Your Good Insurance Agency was started in 2008 with the goal of helping people find high quality insurance at a reasonable price.

We work with over 30 carriers to help you get the best rate with good coverage options. We specializes in personal lines insurance with an emphasis on homes, dwellings (rental properties), and autos. We also help investors with property flip Insurance.

Most of our clientele resides in California however we are also licensed in Utah, Nevada, & Arizona.

Join Our Newsletter

Receive updates about new blog posts, industry news, discounts, & more.